Payback period calculator

Instructions on using the payback period calculator

- The payback period of the solar (PV) system calculator can be used for any currency. Just make sure that all the inputs which require the costs or the prices should all be entered in the same currency.

- The calculator uses the minimum number of outputs to comprehensively calculate the payback period of the PV installations.

- The calculator calculates the savings in individual years (for 25 years, which is the average lifespan of PV panels).

- The balance is the amount that takes all the costs and savings into account and gives a negative or positive output amount. The negative amount corresponds to the time when the PV installation is still recovering its initial capital. The positive value means that the PV installation has started to give Return On Investment (ROI) in terms of saving electricity bills.

- Sometimes the payback period will not be the year where the net balance goes positive, as in consecutive years, large O&M costs can again cause the balance to go negative. Therefore, in this calculator, if the balance value remains positive for 3 consecutive years, only then the payback period of the PV system will be given as the first year amongst those three consecutive years.

Calculations

The calculations of the calculator start with some inputs. The inputs and their description are written below.

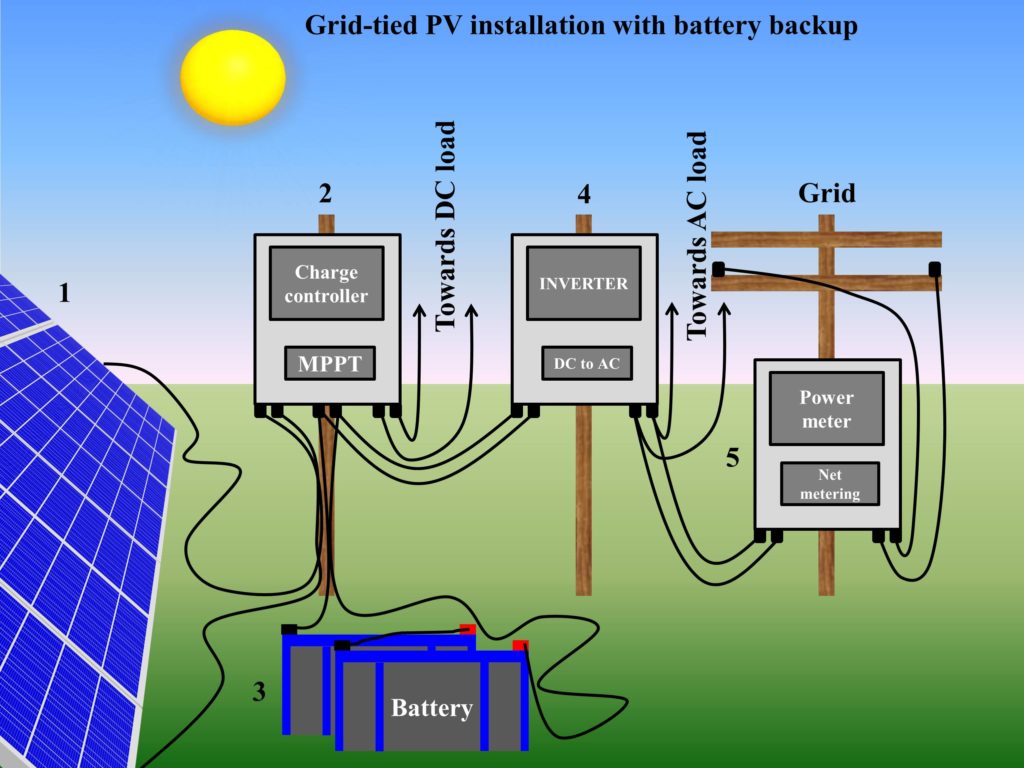

Total cost of a PV system including charge controller+inverter+batteries: This is the cost of installing the entire PV system. It covers the cost of panels, charge controller, inverter, and batteries. This price can be in any currency (all prices and costs should be entered in the same currency though). Here this cost will be represented by Cins.

Total electricity units (kWh) produced by the system in a year: This is the number of electricity units produced by the installed solar (PV) system. The kWh is a unit of energy, which means a 1 kWh energy will be consumed if 1 kW power is utilized in an hour. Here, the number of units will be represented by NU.

The average cost of one electricity unit: This the average price of one unit of electricity in the country of the user. This price can be in any currency (all prices and costs should be entered in the same currency though). Here the cost of one electricity unit will be represented by Cunit.

Number of batteries: These are the number of batteries installed in the PV system. Here, the number of batteries will be represented by NB.

Cost of one battery: This cost represent the price of individual battery installed with the PV system. This price can be in any currency (all prices and costs should be entered in the same currency though). Here the cost of one electricity unit will be represented by CB.

Lifespan of a battery: This input represents the lifespan of the battery. It can vary depending upon the technology of the battery. Here lifespan of the battery will be represented by LB.

Cost of one charge controller+inverter: This cost represents the combined charge controller and inverter installed with the PV system. This price can be in any currency (all prices and costs should be entered in the same currency though). Here the cost of one electricity unit will be represented by CCCI.

Lifespan of charge controller+inverter: This input represents the lifespan of the charge controller and inverter. It can vary depending upon the technology of these devices. Here lifespan of the charge controller and inverter will be represented by LCCI.

Nominal Interest rate: This the interest rate available in the country of the user. The different interest rates can be added by the user if they have an investment opportunity. The interest rate usually refers to the rate at which investment increases over the course of one year if it is invested. For example, if 100,000 currency is invested in a bank at an interest rate of 12%, then if the investment is withdrawn after one year, the amount received would be 112,000.

Inflation rate: This the inflation rate available in the country of the user. Inflation rate usually refers to the rate at which the value of money decreases over the course of one year if it is not invested. The price of everyday utilities decreases over the year, therefore the buying power of money decreases, which is inflation. For example, if we have 100,000 cash is in hand and the inflation rate is 10%, then after one year, the value of 100,000 will be 90,000.

Operation and Maintenance (O&M) cost per year: These are the operation and maintenance (O&M) costs of running and maintaining the PV system over the year. Usually, it is 1.5-2% of the total cost of PV system installation, but in the calculator, it is left open so that any other cost can also be added. This value will, however, remain constant for the entire 25 year period. This price can be in any currency (all prices and costs should be entered in the same currency though). Here the cost of one electricity unit will be represented by COM.

The total savings can be calculated by Eq. 1, where Y represents the number of year, and 0.99 is the factor that depicts the decrease in power generation from the PV system. This loss in power generation will come into play from year 2.

The O&M cost will also include the cost to replace a faulty device (charge controller, inverter or battery). The O&M + equipment replacement cost of a particular year will be calculated from Eq. 2. The cost of batteries and charge controller + inverter will be included on the consecutive year after their lifespan. The division sign in Eq. 2 represents the remainder operation and gives a condition that if the remainder of the lifespan of a device divided by (Y-1) years goes to 0, it will include the cost of that particular device.

The balance calculates the total capital cost with interest and inflation rate for each year and then adds O&M cost, and subtracts the cumulative savings from every year. The O&M cost of the previous year will also be multiplied by a factor of interest and inflation the following year.

A payback period of PV system with 500,000 (Cins), 5000 NU, 16 CUNIT, NB=3, CB=25,000, LB=5, CCCI=100,000, LCCI=10, Interest rate=8%, Inflation rate=7%, and COM=10,000 is depicted in Fig. 1.

Further readings

If you liked this post, you might be interested in reading the following posts.